Use Credit Cards A Lot? Five Ideas To Save More

Amit, a businessman, was a regular traveler. He was investing for all his ticket expenditures with his credit card until a buddy encouraged him to go to get a journey- centric card, another type of credit card. Amit requested such a card which collaborated with international airlines and different domestic providing discounted deals. At present, he has saved a lot of money because all money he uses for tickets and accommodations has been added to his card’s air miles.

In addition to this, Amit surely could relax as the cost of the most spectacular airport lounges is free, which he earlier used to have to pay.

Like Amit, a lot of people today utilize bank cards like a powerful money-saving way. If utilized wisely, you also will see it effective and quite easy.

Here are five ways that credit cards might help you save money:

1) Applying rewards points but not reward cards

You already know just about prize details on a credit card. Different card businesses have diverse level programs with regards to the sort of the card. It means you simply can state for cash discounts while buying from their linked retail restaurants and sites.

But this does not imply that you should usually choose a reward card. Many prize cards come with bigger rates of interest when compared with regular cards. Bank cards give yet another edge of saving cash to you, but if you have a habit of not repaying in time, don't choose it.

2) Determine the best card

Select a type that is suitable for your life. A fuel card is just a much better than the usual reward card in case you go your office in your car every day. And if you are now living in a mutual household and do not use your automobile for traveling significantly while the total acquisitions of your house might be streamed to it, a purchasing card will undoubtedly be advantageous, provided that you settle on time.

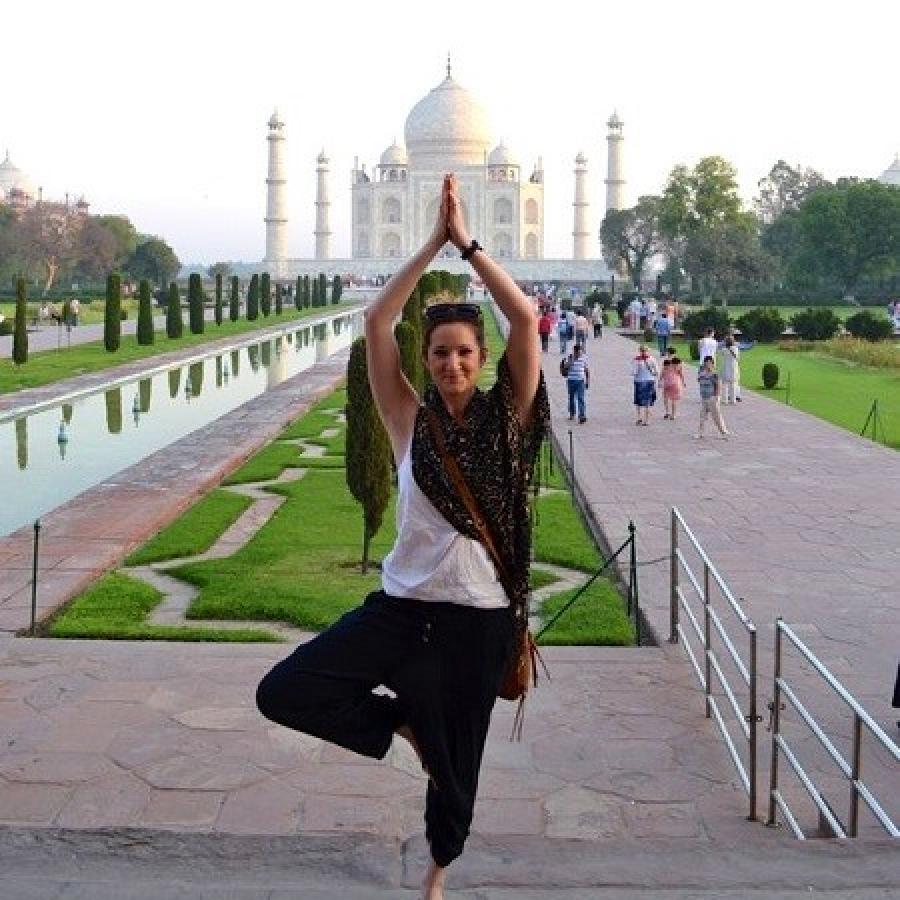

3) Saving on air travel

If you're a frequent flier, a travel-centric credit card is a must as it enables you to get incentives on every citation bought and resort booking created. The air miles accumulated could be used on your next outings. Using a journey credit card not just provides an additional brownie for the next purchase but also discounts on the fundamental citation fees.

4) Catching up all good offers

Do not simply ignore dozens of emails that are promotional ending up within your mailbox. You might be helped by some of them in saving money from credit card issuers and banks. There are many offers from the card companies that are from time to time or holiday time. Do not say yes to every option. Instead, take advantage of these related ones. This includes discount eating, on buying as well as for swiping at some partnered spas and even at your center.

5) Playing it safe

Let's state you come across a high yielding equity investment possibility. However, you don't possess the amount of money together with you right now to speculate. Don't let the opportunity pass away. Withdraw against your credit card and pay back quickly.

FINISH

Charge cards come with a number of schemes and offers to get buyers. It is easy to get one of them. However, overspending is absolutely pushing you into the trouble. And having multiple cards won't help as you cannot collect your items on one, preserving. Thus do not fall into the trap of attractive bonuses